Loan Origination Software

Automate & scale your lending business with our CRM, loan origination software & loan servicing software

Select your loan products below & click get started…

Join 2000+ users across many great companies

They use our loan origination software...

Say hello to your new loan origination software platform!

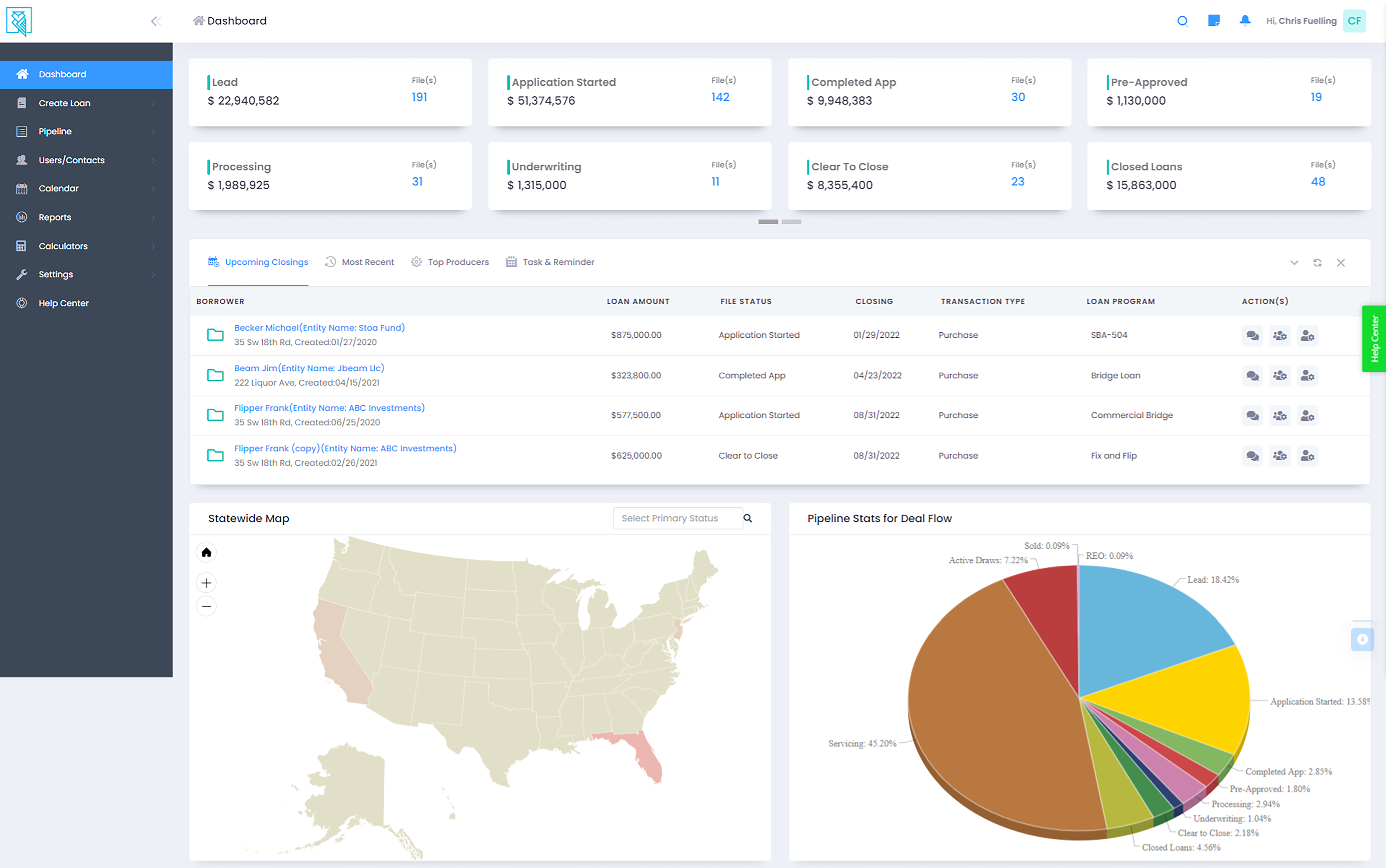

Dashboard

Complete 360 overview of all loans, with quick access to loan status details on upcoming closing & various data analytics

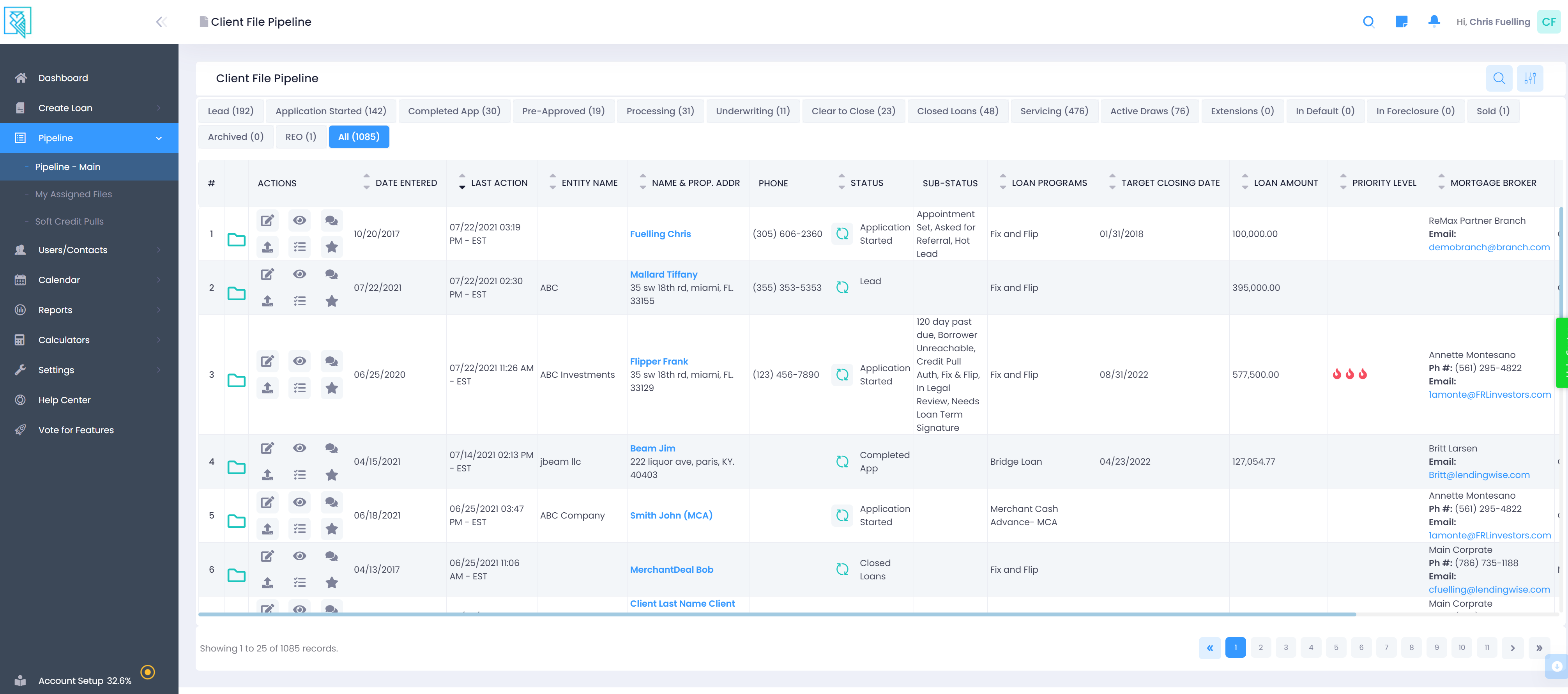

Pipeline

Customizable pipeline that displays your loans the way each user wants. Easily export loan data into loan sizers, Excel, Fannie 3.4,

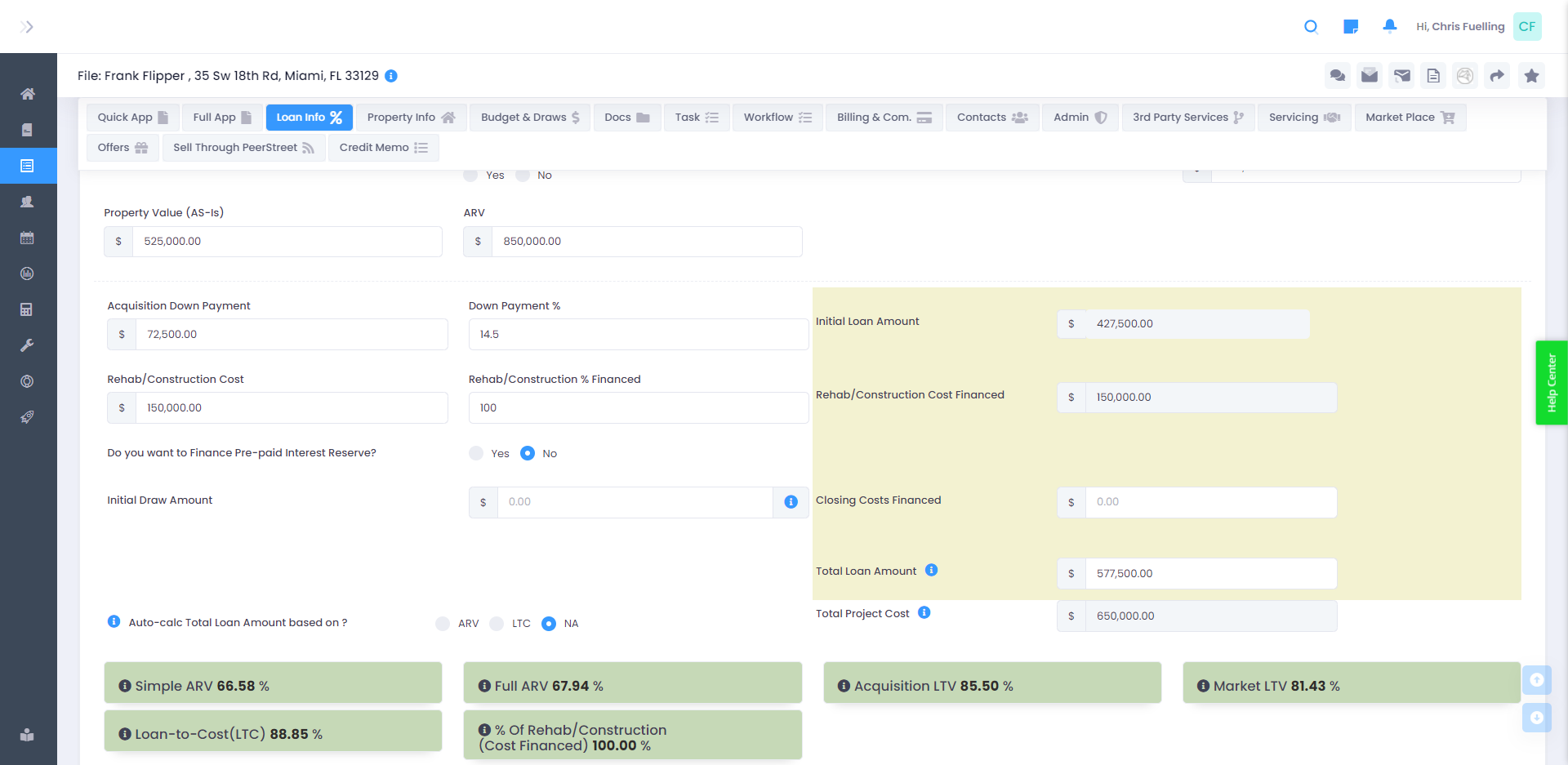

Loan File

A customizable & comprehensive loan layout creates a clean layout within your loan origination software

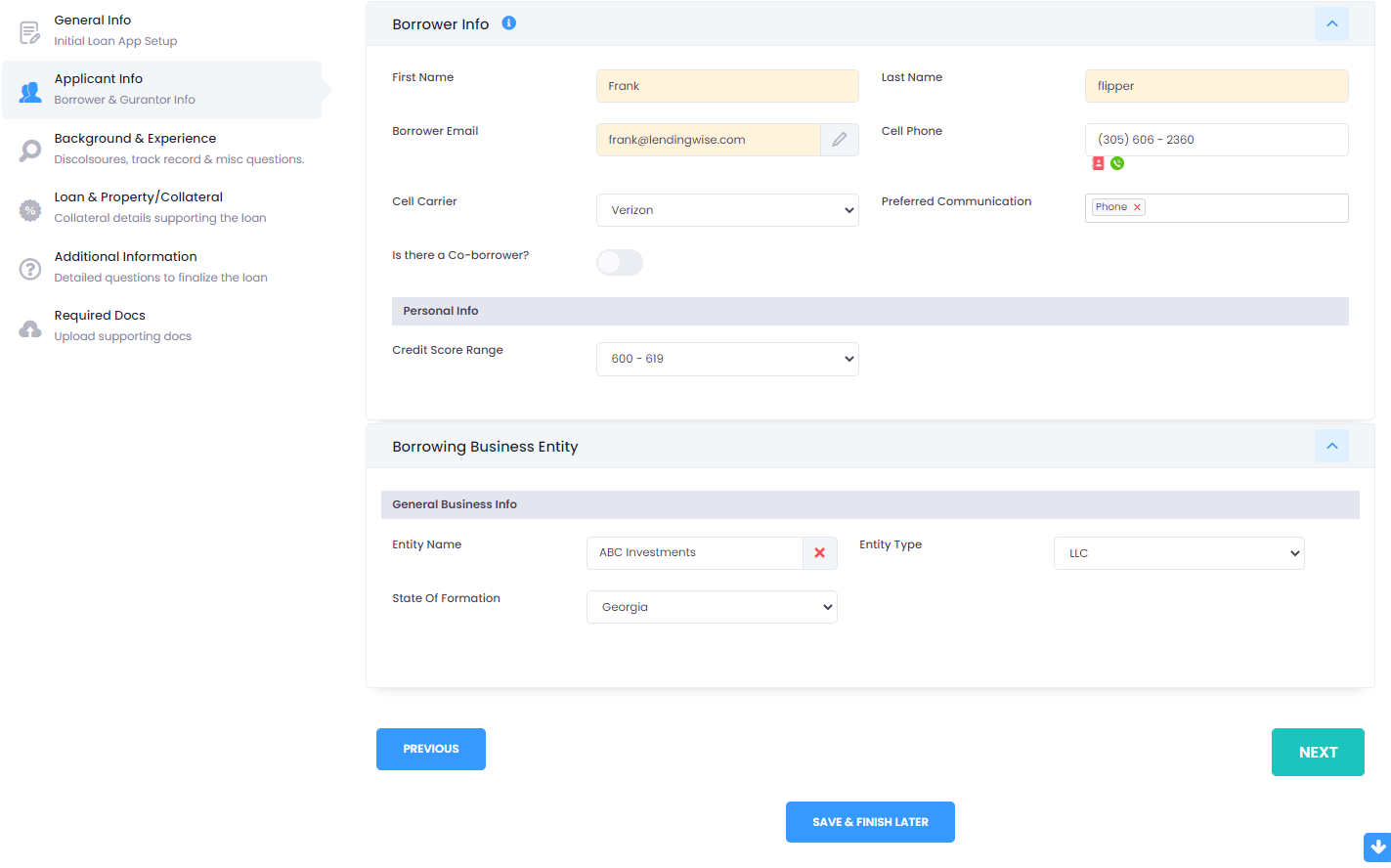

Loan Intake Webform

Our webforms work on every website for any loan type with smart logic that ask for the right questions & docs every time via a quick or full app.

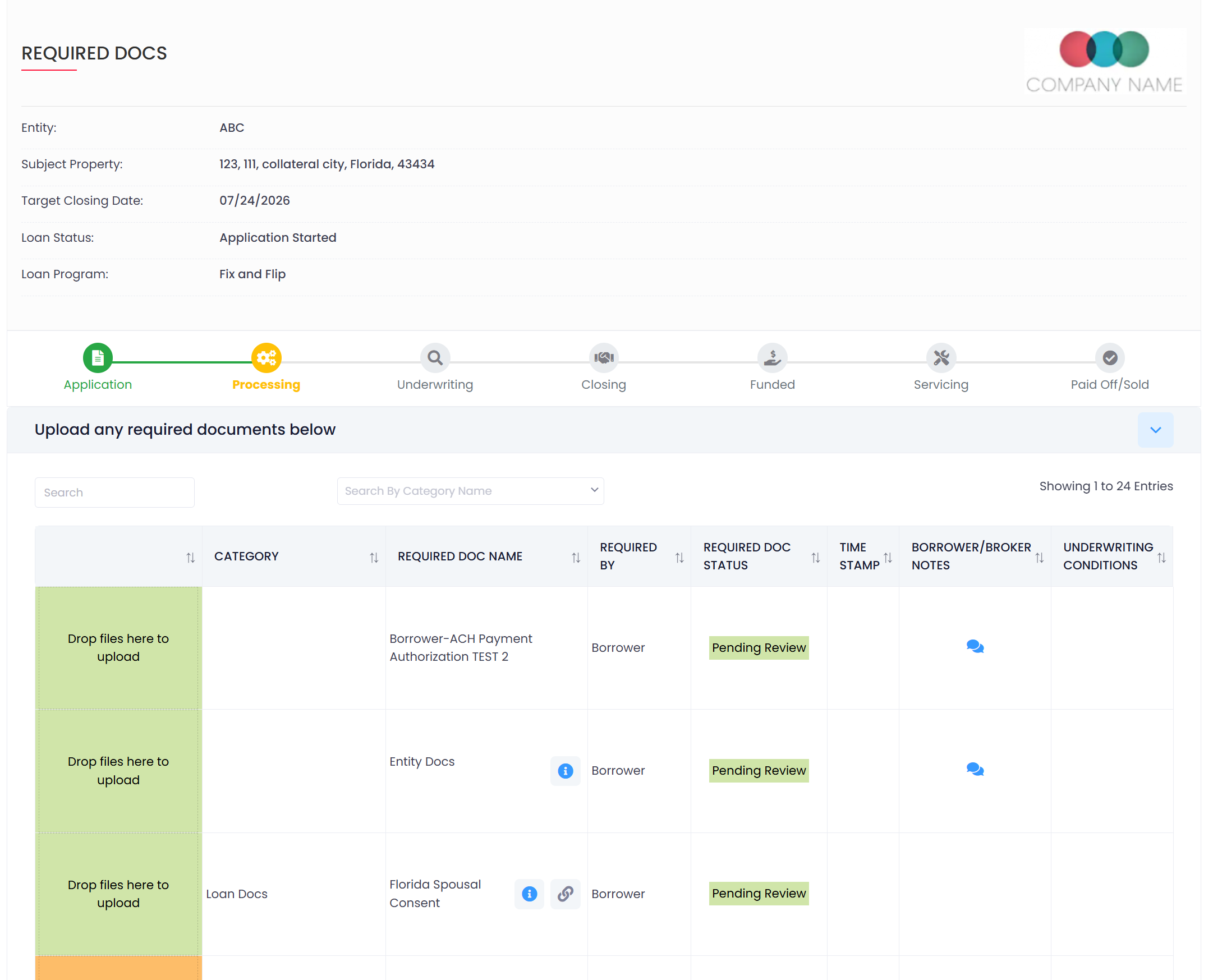

Loan Status/Doc Upload Portal

Put doc collection on auto-pilot with our easy to use loan status & required doc portal.

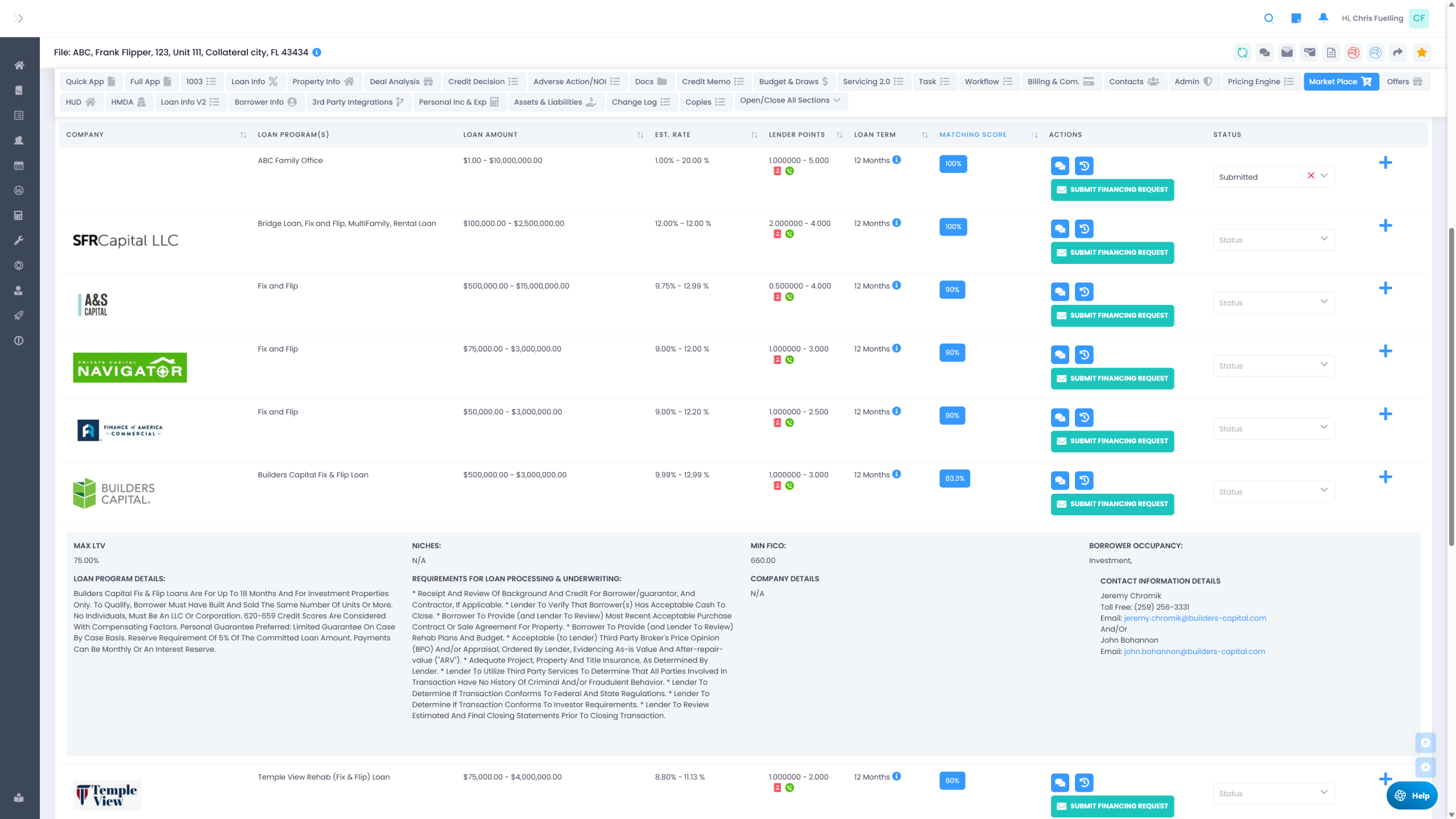

Lender Marketplace

Get the best pricing on all your loans pre-funding or post funding via our lender & investor marketplace.

Dashboard

Complete 360 overview of all loans, with quick access to loan status details on upcoming closing & various data analytics

Pipeline

Customizable pipeline that displays your loans the way each user wants. Easily export loan data into Excel.

Loan File

A customizable & comprehensive loan layout creates a clean layout tailored to your lending operation.

Loan Intake Webform

Our webforms work on every website for any loan type with smart logic that ask for the right questions & docs every time via a quick or full app.

Loan Status/Doc Upload Portal

Put doc collection on auto-pilot with our easy to use loan status & required doc portal.

Lender Marketplace

Get the best pricing on all your loans pre-funding or post funding via our lender & investor marketplace.

A CRM & Loan Origination Software platform for private lending commercial brokers & lenders

Loan origination system

Digital Lending Platform

& Portal

A modern borrower experience with online, mobile friendly portals, customized workflows & paperless loan origination

Connect Your Website

With Our Web Forms

Embed our quick & full app web forms on your site to fast track submissions & accurately collect required docs.

View Live Example Quick App

Real Time Updates & Team Collaboration

Keep your entire team, including brokers, borrowers & 3rd parties updated in real time on loan status & collect required docs.

View Live Loan Status Portal

Bank Level Security & Infrastructure

Our loan origination software sits 100% on AWS & is aligned with SOC 2, ISO 27001, & PCI compliance. We encrypt, secure & back up your data & documents for life.

Visit our Trust Center

Close loans faster & easier with the ultimate digital lending software

Increase borrower engagement & loan conversions with a lending CRM

- -Customizable Dashboard & Pipeline

- -Email marketing with drip campaigns

- -Lead tagging & referral source tracking

- -Assign leads & deals to loan officers or processors.

The industry's most robust Loan Origination Software (LOS) on the market

LendingWise loan origination software (LOS) is flexible & pre-built for Fix & Flip, Rental, Portfolio, CRE Bridge/Perm, Agency, SBA loans or can be customized for almost any loan product. Includes many robust features:

- -Export into Fannie Mae 3.4 file format

- -Industry doc library with E-sign functionality

- -Document assembly powered by Google Docs & Sheets

- -Workflow steps & automated triggers

- -Custom webforms, loan guidelines, & required docs

Compare pricing from lenders & investors via the Lender Marketplace or Pricing Engine

Our pricing engine instantly prices loans for bridge, fix & flip, DSCR & construction loans. Add your own custom products & other lenders/investors!

The marketplace provides a curated lender database of direct private lenders, banks, & other unique capital sources. Automatically get your loan matched to the right lender or investor. You can even invite other lenders & investors to your private marketplace via a deal room.

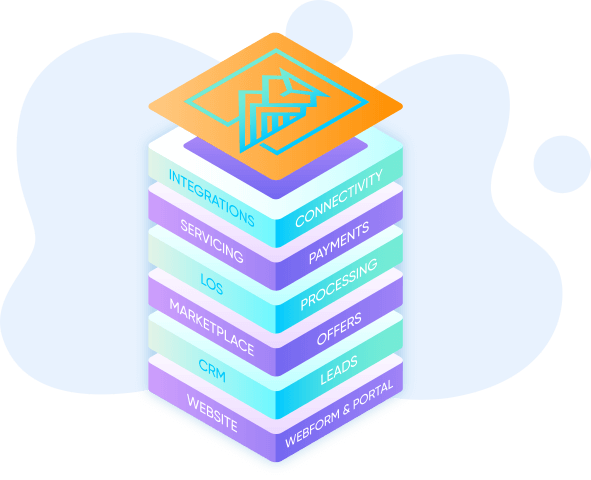

What's In Your Lending Software Stack?

Brokers & lenders of all sizes rely on LendingWise’s cloud based CRM & loan management software platform to help them scale their business.

- -Website integration for loan submission & status tracking

- -Powerful CRM software to manage every contact

- -Track & compare offers from numerous lenders & investors

- -Turnkey & customizable Loan Origination Software loaded with features

- -Track loan payments & draw management with loan servicing software

- -3rd party integrations keep everyone working in one LOS platform

How Our Loan Origination Software Works...

Step 1.

Borrower or originator creates a quick app

Step 2.

Use the marketplace, pricing engine OR deal room to get pricing options. (ideal for brokers)

Step 3.

Borrower E-signs term sheet, completes full app

& uploads required docs

Step 4.

Loan file is complete, ready for funding or shareable to 3rd party lenders or investors!

More Than Just a Commercial Lending CRM & Loan Origination Software (LOS) Platform

We have 15+ years experience in helping organizations deploy our lending CRM & loan origination software for private lending, commercial real estate, business funding, Agency, SBA loans and more.

Launch Quickly

We’ll help you fast-track your loan origination software setup, specific to your company’s needs.

White Label the Entire Platform

The entire platform runs on your domain to look like your own tech stack! For example: app.yourdomain.com

Give your website a face-lift

We offer numerous website templates with an easy-to-use DIY editor. These websites are turnkey & fully integrated with our loan origination software platform webforms.

Data Migration Services

We’ll help you migrate all your legacy data into our loan origination software platform, especially when moving away from an existing loan origination software platform.

Our Loan Origination Software Integrates With...

LendingWise is the leading LOS platform & our numbers do the talking…

Our LOS Is Loved By Our Customers

We go above and beyond for our clients, because their success is our success. We help every step of the way during the implementation stages of your loan origination software.

LendingWise delivered a robust, secure, cloud-based platform that perfectly aligns with our CRE lending requirements. Our entire team—from sales to back office—and even our external partners like brokers and borrowers, seamlessly use our white-labeled digital lending platform, which integrates effortlessly with our existing Cross River banking products. Great job LendingWise Team!

Jaime Finkelstein

Head of Operation | Cross River Bank

LendingWise has been an invaluable CRM & LOS software platform to help us manage our borrowers, broker network and ever growing private money deal flow. They make our intake, processing, underwriting & loan closing process extremely efficient, which helps us continually grow and scale our hard money lending business!

Jeff Fechter

CEO | HouseMax Funding

After trying several commercial lending & hard money lending systems, we have finally found the perfect CRM & LOS software platform to scale our growing business. They have numerous robust features, it’s very customizable, and they are always willing to work with our unique requirements. It’s been amazing!

Matt Flores

EVP | CV3 Financial

Frequently asked questions

The LendingWise lending CRM software & loan origination software platform was built to help manage the entire lending tech stack from CRM, LOS, Pricing Engine (PPE), Servicing software & deal placement via lender marketplace. Organizations can now deploy a lending software platform in days vs months compared to many off the shelf loan management software providers or choosing to custom build your own loan origination software solution. No other CRE private lending software provides as many features and functionality out of the box, like LendingWise

The lending CRM software, loan origination software, & loan servicing software, can deploy in minutes and works out of the box. With some basic training via our white glove implementation & training service, self help knowledge base & Video Library, you & your team will be up and running in days. However, for detailed configurations likely needed for private lenders or institutional lenders, expect to invest several weeks in training to learn the advanced configurations. For unique customization requirements, expect a 2-4 week turn around time depending on the complexity of your requirements.

The short answer is Yes, however it depends on the data integrity and cleansiness. Data Migration is never a simple transfer process and delicate care must be taken to ensure data format and accuracy remains in tact. We have done migrations from all major systems, including associated file attachments.

We work with large institutions with strict vendor requirements followed under SOC 2 & ISO 27001. Following these requirements is made possible by hosting our application 100% on AWS. In short your data is encrypted, backed up daily & we follow strict privacy policies to not share your data with 3rd parties.

We do not have a mobile app yet, but we ensure the most important pages of the loan origination software are mobile responsive providing a smooth user experience for borrowers, brokers and all parties involved with your loans.

Choose from numerous Pre-built Loan Programs like fix & flip, rental loans, portfolio, construction, bridge, CRE, Agency, SBA, MCA, & business funding. Our loan origination software has over 1000+ fields related to numerous loan types for personal & business purpose loans backed by real estate, equipment, & other collateral types. Customize your own loan programs & set the required fields, docs, guidelines, etc…

We offer 2 options on white labeling… Enterpise white label plan will make the entire loan origination software work on your domain like app.yourdomain.com, remove Fueled By LedingWise logo from webforms, and ensure all emails send from your domain.

Additionally, you can have a lite white label plan that only handles the email and removal of fueled by LendingWise logo.

You can create unlimited users for brokers & borrowers at no additional cost in our private lending loan origination software. Those users can submit deals via online web forms and check doc & loan status via the loan’s dedicated, encrypted URL. If you want borrowers to login to their portal, they need an active user seat. Borrowers can always login to their loan portal at no extra cost.

With our private lending CRE loan origination software platform, we do not believe in forcing annual contracts on our clients. We offer month to month contracts with quarterly or annual options available for discounted pricing.